For an unprecedented time, the Republican Party seems to have nothing but extremely, unbearably precedented ideas. And for their inability to care or change, Americans will suffer.

This past monday, Director of the National Economic Council Larry Kudlow told Fox Business all about the President’s bold new plans for a Phase 4 Coronavirus relief package, which currently include “provisions like a payroll tax holiday, ‘modest’ return to work bonuses, unemployment reform, a Paycheck Protection Program extension, targeted direct assistance, and a capital gains tax holiday.”

Let’s start with a metaphor: Imagine a giant toilet filled with diarrhea is overflowing and the government proposes a tax holiday on plungers as the solution.

You probably already get my general point, but further discussion is in order.

The pandemic is worse than it’s ever been in the United States. On July 14, we reported 65,568 new cases. Florida, a state of 21 million people, reported 9,194 new cases. For comparison, the same day, South Korea, a country of roughly 50 million, reported 39 new cases.

Unemployment also remains really, really bad. Per the July Bureau of Labor Statistics Jobs Report, even as the unemployment rate fell in June (to an astronomical 11.1 percent), the number of (disproportionately non-white) jobless and permanently laid-off workers increased. The report is complicated, but, by-and-large, it spells long-term economic trouble. Over 30 million Americans currently depend on the $600-per-week expansion to federal unemployment bonuses. That program is set to end on July 25, with nothing currently in stone to replace it.

Republicans both in Congress and the White House have been openly hostile to the benefit expansion. Senate Majority Leader Mitch McConnell recently referred to the benefits as a mistake, claiming that they’ve made it harder to get people back to work. Treasury Secretary, Steve Mnuchin ’85, told CNBC on Monday to expect the next rounds of benefits to be no more than 100 percent of workers’ prior wages, millions of whom make less than $600 per week.

Even as the White House has recently shown some openness to expanding benefits, how benefits are structured, how much they are, and for how much longer they’ll last is all up in the air. In the interim, people will go hungry, people will skip on paying rent, and the economy will further implode.

What unites Republicans’ disdain is the view of the payouts as a “disincentive to work.” The line of thought goes as such: people, faced with a choice of $600 for staying home or $600 for going to work, will choose to stay home. People might even choose $600 over, say, $1000 if it means they don’t have to go to work. Unemployment benefits, in this view, are akin to paying people for choosing not to work.

There are a few problems with that. One, workers cannot voluntarily quit their jobs and collect Universal Income (UI). Two, workers can return to work (partially) and still collect (partial) benefits. Three, barring the fact that no correlation between state unemployment benefit generosity and the rate at which people have returned to work during the pandemic has been found, even the theoretical model Republicans are operating under is false. There aren’t jobs for workers to return to!

One way to observe this is looking at online Glassdoor’s job opening data, which shows job openings down 25 percent since March. With millions more unemployed now than in March, you’d expect the opposite as employers look to fill the vacancies. But it’s not that workers have disappeared: work itself has disappeared.

Republicans’ inaction on renewing benefits until after they lapse is kicking the can down the road. Forcing people off of unemployment benefits—when opportunities for employment are scarce—is basically kicking the can off a cliff. The only way to get work back is to fix the virus.

But not so fast! Mr. Kudlow has a plan for that. Tax holidays are here to save the day.

“We will try to make [the next package] targeted,” Kudlow told Fox Business, “we will try to incentivize not just work, although work is crucial, and going back to work. We want to incentivize investments, we want a pro-growth package.”

The two proposals that bookended Kudlow’s comments are a payroll tax holiday and a capital gains holiday. Simply put, a payroll tax is a tax taken off employees’ salaries by their employers and paid to the government. The lion’s share of the payroll taxes go to Medicare and Social Security. A tax holiday would suspend the collection of the tax (probably until the end of the year).

There are a couple things wrong with that. First, payroll tax holidays don’t help the jobless, who don’t pay the tax because they aren’t on a payroll. Second, the poorest people are the most likely to spend any extra money they receive from a tax cut (because they have to). As calculated by the Wharton Budget Model in response to the White House’s previous attempt to push the payroll tax cut in March, the poorest 20 percent of households would receive only 2 percent of money released by a tax holiday. The problem is that there is an inverse relationship between the amount of money a worker receives from a payroll tax holiday and their propensity to spend that extra money. The richer you are, the more tax you normally pay, so the more you get from not paying that tax. Overall, a payroll tax cut would do very little to help the economy.

On the bright side, the other proposed tax holiday is even worse. The capital gains tax is paid upon the sale of capital assets like stocks, bonds, and real estate that were held for over a year. Capital gains tax rates are at a near-century low, and are taxed much lower than regular income. The idea is that lower taxes equals higher profit, and more money for investors equals more investment in the economy. Everyone wins, right?

Well, let’s look at who has a stake in the stock market. Even when you include indirect means of ownership like mutual funds, IRAs, 401(k)s, and other retirement counts, the bottom 80 percent of Americans own 8 percent of stocks. The top 10 percent own 81 percent.

A proponent might argue that the extra investment by the top 20 percent of Americans would dissipate to the other 80 percent and help get us all out of this mess. The evidence suggests otherwise. The massive 2017 tax cuts, for instance, lead to little new investment and lots of stock buybacks. A study of the the 2004 Homeland Investment Act, which gave corporations a one-time tax holiday on the repatriation of foreign earnings, found that “repatriations did not lead to an increase in domestic investment, employment or R&D—even for the firms that lobbied for the tax holiday stating these intentions and for firms that appeared to be financially constrained. Instead, a $1 increase in repatriations was associated with an increase of almost $1 in payouts to shareholders.” Basically, even more so than the payroll tax holiday, a capital gains tax holiday will pervert incentives, help the rich get richer, and fail to do much for struggling people.

These aren’t novel proposals, they’re old, tried-and-failed ideas that the Republicans just can’t let go. Nevertheless, the White House continues pushing for these supply-side shortcuts to growth. They’re pushing for a capital gains tax holiday now, they pushed for a capital gains tax holiday in March. In 2009, the anti-tax, conservative foundation “Americans for Tax Reform” proposed tax holidays as a way out of that recession, too. And speaking of holidays, who can forget Arizona Senator Martha McSally’s TRIP (Tax Rebate and Incentive Program) proposal, which proposed $4000 in tax credits for Americans who took vacations during the pandemic. Yes, you read that right. A tax credit for vacations during a pandemic.

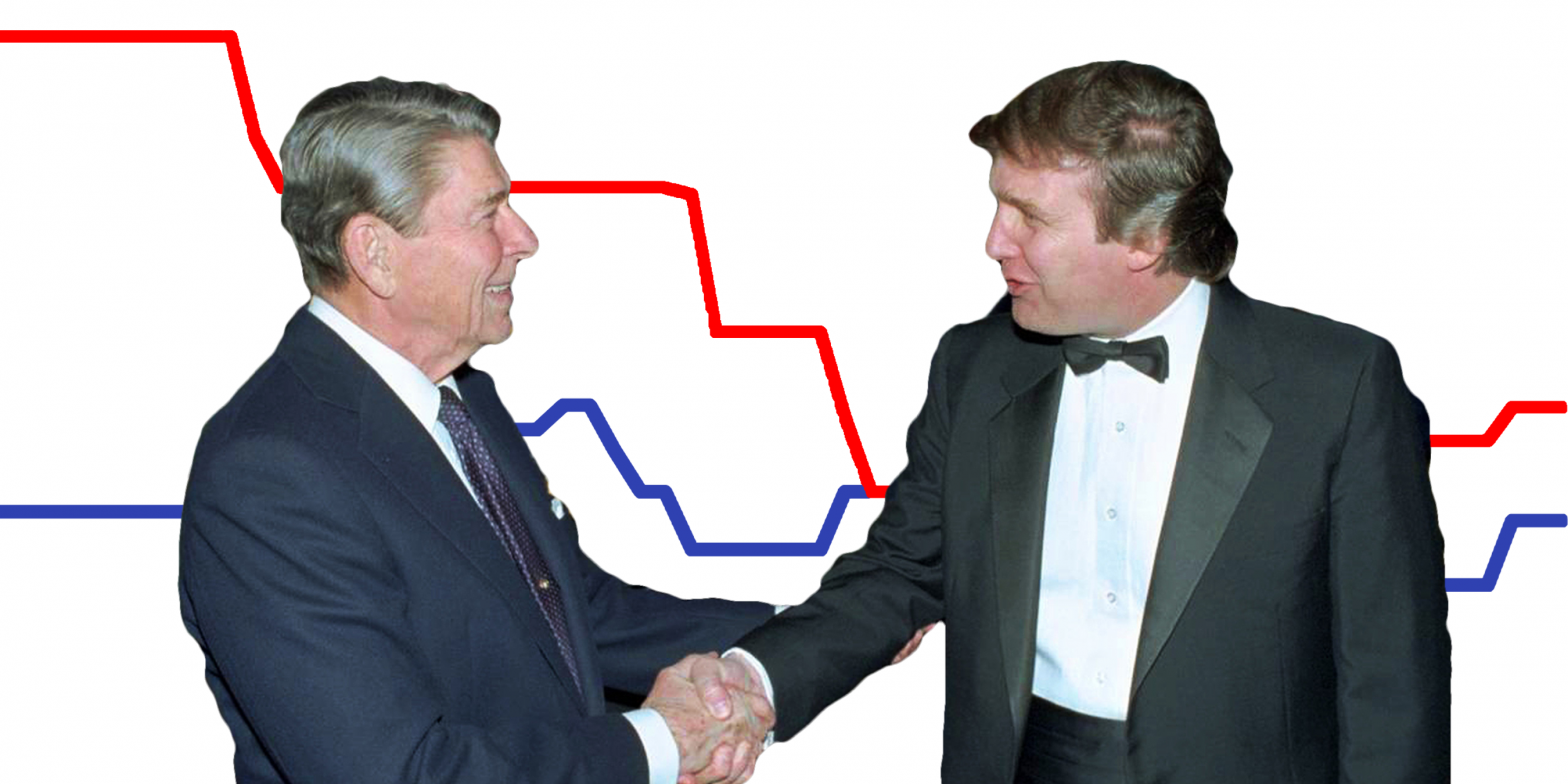

While supply-side theology is currently centered in the Republican party, it hasn’t always been that way. A good way to assess the power of an administration is its ability to reshape its opposition. (That’s a paraphrase of a quote from an Oxford historian whose name I cannot remember for the life of me. If you know who I’m talking about, please email me at [email protected]. Please.) FDR, for instance, reshaped both the Democratic and Republican parties in his image for a few decades. So did Reagan, with a brute-force conservatism that created an entire generation of supply-side Democrats—Democrats like Rep. Ed Jenkins (D-GA), who proposed a two-year capital gains tax holiday in 1989.

The scripture and congregation of the tax-cut church still live on today by-and-large, but not exclusively, in the Republican party.

For a President who ran on shaking things up and rooting out the Washington swamp, the Trump administration is chock-full of GOP lifers. Of Trump’s cabinet-level appointees, 11 served directly either in the W. Bush, H.W. Bush, or Reagan administrations. Many who didn’t serve in one of those administrations had no experience in government.

Senate Majority Leader Mitch McConnell—who has as much, if not more, sway over the next package as Trump—served in the Ford administration and was elected to the Senate in 1984 amid Reagan’s reelection landslide. And how can we forget the economist Arthur Laffer, architect of supply-side economics, former advisor to both Reagan and Trump? Now is also a good time for a brief refresher on the reason for the season Larry Kudlow, whose first appointment was in, you guessed it, the Reagan Administration.

This isn’t to say experience is intrinsically bad or that old people inherently have bad ideas, though. What it is to say is this: the Trump administration and its sycophants in Congress are either unwilling or unable to wrap their heads around two things: you can’t tax-holiday your way out of a recession, and you certainly can’t tax-holiday your way out of a pandemic-induced recession. But that won’t stop them from trying to push the pull door. In fact, this administration’s entire approach is predicated on trying to push the pull door, and never ever admitting it. President Trump isn’t unique in this, but he’s particularly bad. The man cannot admit he was wrong. Ever. It doesn’t matter how small the matter, how inconsequential (misidentifying Alabama on a map) or how drastic (taking months to tepidly come out in support of masks).

Of course, one might wonder if the Trump administration knows all of that: if the goal of the aforementioned policies all along was to help the rich get richer, to never ever learn or admit you were wrong (whether it’s about masks or taxes), and to turn a blind eye to the millions of Americans who will suffer and die because of it.

One could certainly wonder.